Rising Prices, Rising Ages: The Wealth Gap Widens

A data-driven look at the growing generational wealth gap in housing and how KeyStep is working to reconnect younger buyers with the path to ownership.

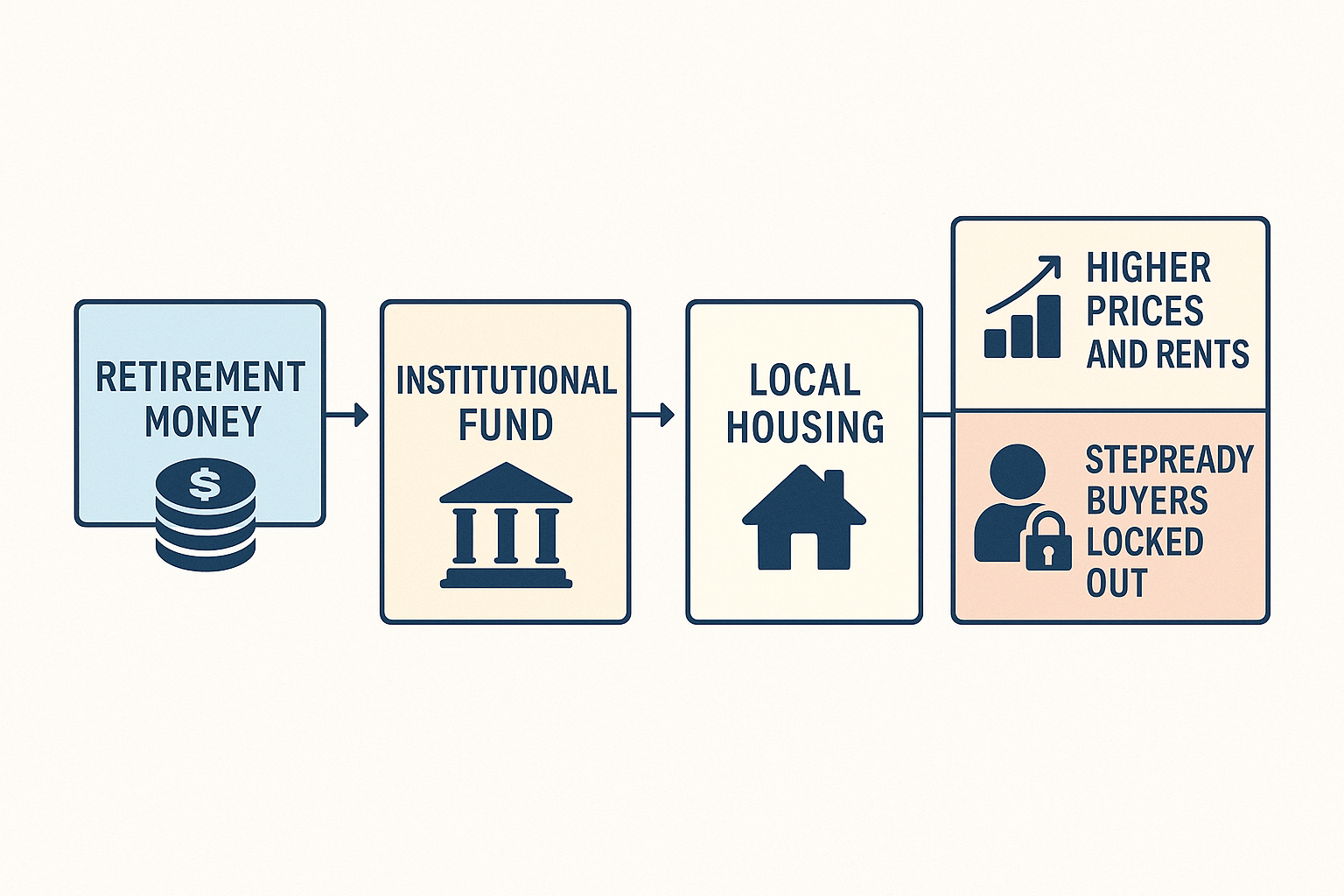

When Retirement Money Meets Housing: How a New Executive Order Could Hurt StepReady Buyers

When 401(k) Dollars Enter the Housing Market

The executive order doesn’t change who lives in a home — it changes who owns it. By opening retirement accounts to private real estate funds, it creates a new stream of low-cost capital for large institutional buyers. Those funds often target working-class and minority neighborhoods for their high rental yields, competing directly with StepReady buyers. The result is a familiar pattern: local homes get purchased as investment assets, prices and rents climb, and the very people closest to ownership are pushed further out of reach.

Letting Capital Call the Shots: Lessons from Ireland’s Housing Crisis

When Ireland turned to institutional capital to solve its housing crisis, the results were short-lived—and costly. Over 42,000 landlords exited the market, housing starts collapsed, and rents continued to rise. This post breaks down how policy decisions unintentionally destabilized Ireland’s housing system—and why KeyStep believes housing should be seen not as an institutional financial means, but as a community end.

What Happens When Communities Own?

Before the Tipping Point: Why Cities Must Act Now on Institutional Investment in Housing

This chart compares key housing market metrics from 2021 to projected levels in 2050—based on current growth trends in institutional investment.

It highlights how private equity firms, hedge funds, and corporate landlords are rapidly increasing their share of home purchases and built-for-rent developments. At the same time, the share of homes owned by small landlords is shrinking, and the pipeline to ownership is narrowing.

KeyStep COMMUNIQUÉ

It all begins with an idea.